Doom sells. That's the simple fact. Whatever you may think of their substantive record, you have to ruefully appreciate Zero Hedge's business model: if Doom sells, then the way to really monetize economic commentary is to aggregate Doom! And boy howdy has it ever worked. For them.

I mention this because there is yet another Doomgasm going on in the place where I started bloggging, this time about the collapse in commodity prices. So why be bothered?

Because here's a few of the comments by the financially unsophisticated readers, particularly after the Pied Piper of Doom touted the blog "The Automatic Earth:"

"Articles like this make me feel like deer in the headlights.

"Really, if true, how the hell is one expected "to prepare" for that scenario?"

---

Causing this kind of unfounded panic makes my blood boil (although, to his credit, the author of the article is not calling for an economic crash, despite the Apocalyptic title he chose for his piece).

So let's cut to the chase. What is the meaning of the commodity collapse"

1. sucks to be China

2. really sucks to be a supplier of China

3. Teh Awesome to be a consumer of products.

Why? Prices, supply and demand for industrial commodities are set globally, not locally. A comodity price decline usual ly happens because manufacturers are using less commodities, i.e., there is a manufacturing recession. Commodiity prices go down more than produceer prices, and producer prices go down more, or increase less than consumer prices.

Here's the best example I have read. In the late 1800s, one of the most important things happening in the US was the building of railroads. Each year new track would be laid down. So suppose in a given year railroads lay down 4,000 miles of track. Then the next year they lay down 2,000 miles of new track. Even though there is now a total of 6,000 miles of new track, the suppliers of track saw their sales fall by 50%. Ouch! But rail passengers benefitted from the rail lines.

Ironically, the best evidence indicating that consumer countries have little to fear from a commodity collapse comes from ECRI, which sevcral years ago published a presentation on "Yo Yo economies", in which they wrote:

The rising export dependence of these [suppliers of suppliers] economies, with growing involvement in global supply networks, makes it increasingly difficult for economies to decouple, especially for suppliers of early-stage goods that have embedded themselves further up the supply chain and farther away from the final consumer. This makes them highly vulnerable to the Bullwhip Effect and at the mercy of cyclical fluctuations in end-user demand growth.[my emphasis]

It is necessarily true that if supplier economies are especially vulnerable to cyclical fluctuations, then economies which are primarily consumers of end stage goods, like the US, are the least vulnerable. If supplier economies are especially unable to decouple, then it followers that consumer economies are the most likely to be able to approach decoupling.

Elsewhere in their presentation they wrote:

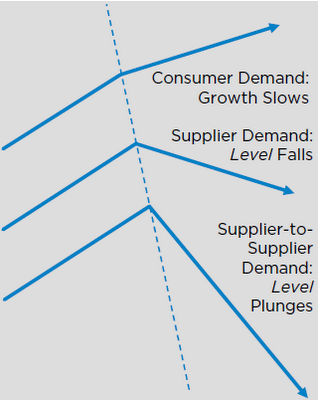

[D]eveloping economies are very much subject to the Bullwhip Effect, where small fluctuations in consumer demand growth get amplified up the supply chain into big swings in demand as we move away from the consumer. So, smaller shifts in end consumer demand growth translate into larger fluctuations in intermediate goods demand, and even bigger ones in input material demand, and especially, raw material prices.In other words, an absolute contraction in supplier countries can be caused by simply continued growth, but at a slower rate, in a consumer country. Which means that converse is also true: an observed contraction in supplier economies (like China) does not necessarily mean that there is a contraction in consumer economies (like the US). Rather, consumer economies may simply continue to grow, just at a slower pace.

Even a modest decline in consumer spending growth in developed economies like the U.S. and Europe can help trigger a significant downdraft in the level of demand from suppliers and, in turn, a serious downturn in the level of demand for “suppliers to suppliers.”

As if that weren't clear enough, ECRI supplied this very helpful graph:

Notice that the arrow at the top for consumer countries in ECRI's diagram is still pointing UP.

Think of the middle line as China, the bottom line Australia and Canada, and the top line as the US. In fact, the situation is probably better than that for the US, because the premise of the graph is that there is a consumer slowdown. ECRI then calculates the effect on suppliers. But here, the consumer slowdown is taking place in China. So there is no reason to think that other consumming countries, like the US, will slow down.

But to turn back to the article in question, as to which the Pied Piper of Doom touts a recent piece on the blog "The Autormatic Earth." What were the y saying back in the Great Recession? Well, here's what they though was goiong to happen as of December 12, 2008:

Last month I started warning of millions of lay-offs to come in the US economy. Since then, we've seen a November job loss of 533.000, as well as predictions of pink slip totals of a million and more every single month in 2009. ...

[S]upermarket shelves will be as empty as electronics stores ....

Banking and investing as we've known it won't be back for at least decades. The upcoming round of bank failures, which will leave very few, if any, standing, cannot be prevented.

Umm, no.

The stock market bottomed in March 2009. What were they saying then?

On March 2 they wrote:

The stock market bottomed in March 2009. What were they saying then?

On March 2 they wrote:

The US Government throws 30 billion more pearls before the swine at AIG.... [note: the US actually made a profit on its AIG investment, which was paid back in full]

The downturn is nowhere near over, or at a bottom, or anything like that. It will not be a straight line down, but the trendline is certain. Many pundits now claims that a Dow at 5000 is some sort of bottom, but don't count on it. As for home prices, they will keep tumbling and lose at least 80% of their peak values.

[note: house prices bottomed at the beginning of 2012, about 30% under peak values].

On March 4 they wrote:

Almost 700,000 Americans lost their jobs in February, which is 100,000 more than in January. The revised versions of those numbers will be between 10% and 20% higher. .... So I assumed that for the rest of 2009 pink slips will rise by 100,000 every month compared with the month before. That is, for the sake of scribblings I pretend that the economy will not deteriorate exponentially. I know that takes a lot of pretending, but since the results are bad enough even when I pretend, I'll stick with it.

The total number of jobs lost would be about 13.7 million on December 31.

Peak job losses were recorded at -824,000 in April. While January was revised higher, February wasn't. Job losses didn't increase 100,000 per month, let alone exponentially, on average they *decreased* 100,000 per month after that. So they were only off by about 10,000,000 jobs in their "conservative" estimate.

And on March 9, 2009, the exact day of the stock market bottom, they wrote:

Warren Buffet says that stocks are the best investment ... It won't be for all of the millions of investors who take his advice. Why would anyone listen to [Buffet], ... it's beyond me.

Pied Piper of Doom: "Shifted to 75% Cash/Bonds Friday!"

The author of the piece about the commodity crash today: "The rally is done. .... If you are buying now you are simply giving your money away. Now is the time to go to cash. Maybe in a few months things might be different."

Of course, instead the stock indexes have more than doubled since then.

The author of the piece about the commodity crash today: "The rally is done. .... If you are buying now you are simply giving your money away. Now is the time to go to cash. Maybe in a few months things might be different."

Of course, instead the stock indexes have more than doubled since then.

So anybody who takes advice from them about what to do with their money is playing with fire, to say the least. Caveat reader.