- by New Deal democrat

In his 1993 book, Prof. Geoffrey Moore, the founder of ECRI, identified 4 data series as long leading indicators - by which he meant that they generally turned, especailly at peaks, over 1 year before the turning point in the economic cycle. Those 4 indictors are corporate bond yields (inverted, i.e., the lower the better), real M2 money supply, housing permits, and corporate profits after taxes. So let's take a look at each of them.

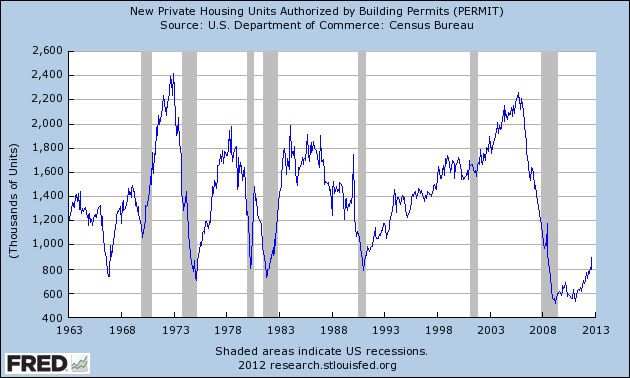

Let's start with housing permits. As readers of this blog well know, housing has been the surprise postive story of 2012:

These are in a nearly 2 year old upswing. Since it is the direction, not the level, that is important, these certainly aren't indicating a recession in the near future.

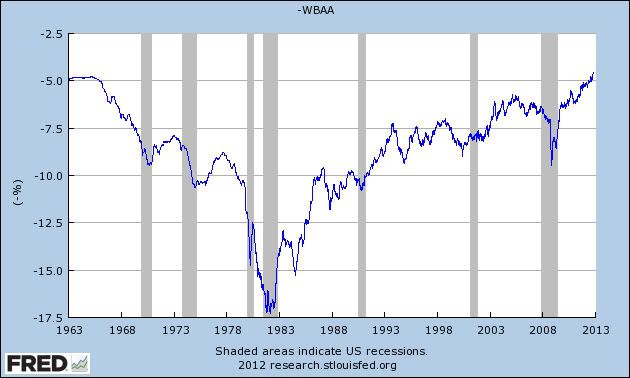

Next, here are bond yields (inverted). I've used BAA corporate bonds, but AAA bonds tell the same story:

Corporate bonds also support a conclsuing that the economy will continue to expand.

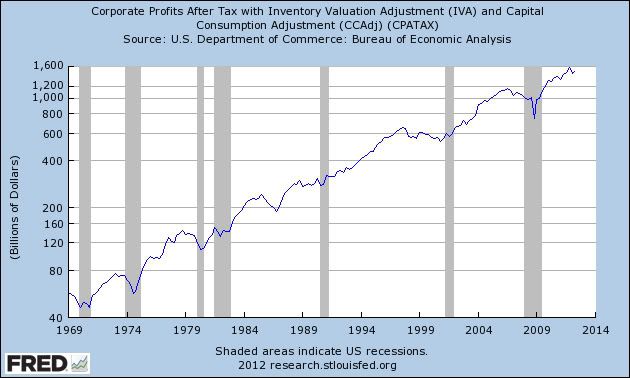

Next, here are corporate profits after taxes:

These have indeed turned down in the last couple of quarters. But typically they must turn down for more than a year before a recession starts. While this is certainly a caution looking forward into 2013, they don't support a recession story right now.

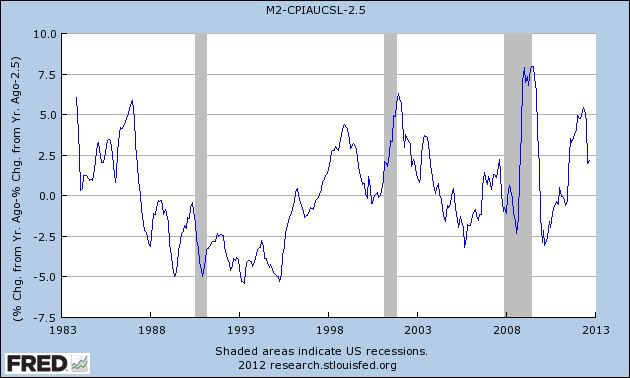

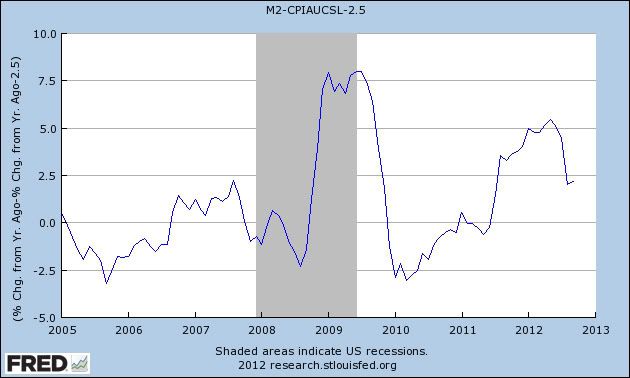

Finally, here is real M2. A level of real M2 growth under 2.5% appears to be the most consistent with a recession level:

Here the story is much more equivocal. Real M2 has been quite positive for the last year and a half. Before that, however, real M2 had been under +2.5% and even briefly negative YoY. Here's a close-up of the last decade:

Note that real M2 was negative for about 2 years in 2004 and 2005. The "great recession" did not begin until 2 1/2 years later. On the other hand, real M2 went negative again shortly before the great recession began.

Moore's work was primarily based on post-WW2 recessions. When I exanubed Economic Indicators during the Roaring Twenties and Great Depression, I found that during deflationary periods, real money supply had less of a lead time and sometimes was coincident with expansions and contractions, rather than leading.

Since there are strong deflationary forces at play, I am inclinded to downplay the negaitve readings of 2010 and early 2011. Note, however, that in the last few months real M2, while positive, is much les so than before. If it deteriorate much further, that would also give me a lot of pasuse about 2013.

In summary, 2 of the 4 indicators do not support an end to the expansion anytime soon, while 1 is a negative for 2013, and the final 1 is equivocal but also supports caution as to whether the recovery will continue into 2013.