Over the last few months, the markets have been consolidating. However, in the low volume environment of holiday trading, it appears we may have a break-out.

On the weekly chart, we see a strong candle breaking through upside resistance. The MACD is increasing (and is just about to move into positive territory) and the volume indicators are slightly bullish.

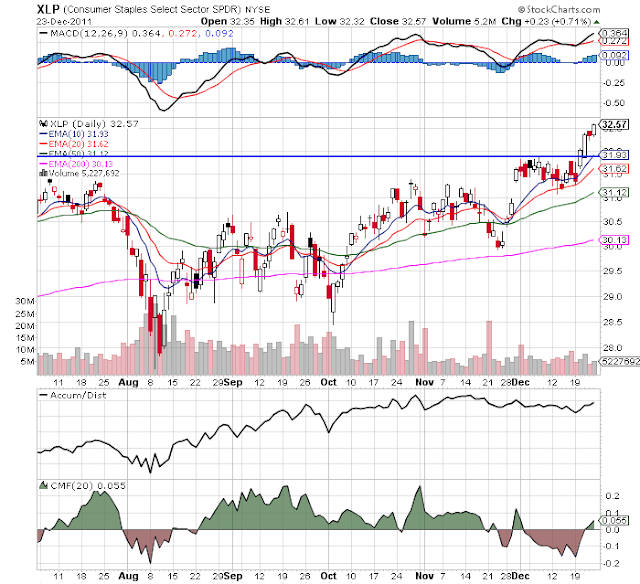

On the daily chart, we see more detail of the break-out. First, the move is on very low volume on a weak candle. The volume indicators are weakly positive and the MACD is weakly bullish. In short, there is nothing on this chart to show a strong break-out, but there is technical confirmation.

The big reason for the move was a strong surge at the end of trading which was most likely technical buying.

In addition, we see money moving out of the treasury markets:

The IEIs have broken key support.

The IEFs have broken support -- although weakly, as have

the TLTs.

So, we have a major equity index weakly breaking resistance, and some money moving out of the treasury market, although doing so weakly. Notice that on both ends of this situation, I'm using he work "weak." What we're not seeing is a strong surge into the SPYs or out of the treasury market; the movement is far more technical. That does not mean it's not real, or couldn't lead to profits; but it does mean we need to look under the hood at various market sectors to see where the growth is coming from. And this is where the break-out runs into serious problems.

The move higher is coming from defensive sectors -- consumer staples, utilities and health care. These are sectors that we would expect to rally when investors are concerned about what lies ahead.

This is not to say these are not important sectors. Combined, they comprise 27.8% of the S and P 500. And this is also not to say a real break-out could not be happening. It's just the evidence does not lead me to conclude the markets rose because people are excited by the future. Instead, it looks like the rally was caused by people saying, "we are scared about the future and want to put our money into market sectors that are safer when things get tough."