Some of you may have noticed, commodities have crashed in the last week. Oil went from over $114 to about $97 earlier this morning. According to Bespoke Investments, this is the most serious crash since 1980 (when the Hunt Brothers' attempt to corner the silver market imploded).

Most likely, this crash too goes back to the silver market, which has had a150%+ parabolic move in the last year, from about $18/ounce to just under $50:

There have been substantial allegations of manipulation made (as in, ETFs that are supposed to hold actual bullion, instead holding vapor). Margin requirements have been raised 4x in 8 days.

As of the end of yesterday, silver was off 30% in a single week. Gold was off about 7%. Oil was off almost 10%.

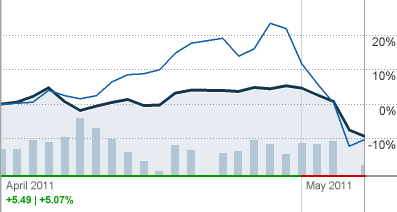

Note, however, that while Oil and some other commodities made tops on the same day as silver (last Thursday), their declines were very orderly until AFTER silver crashed. For example, here's Oil:

Note that the big move in Oil comes on the third day of the silver crash.

That suggests to me that people who were caught flatfooted by silver's move, and had margin calls, had no choice but to cash out other commodity positions to meet the calls. A similar thing happened with hedge fund redemptions in early October 2008 causing stocks to crash.

One important difference is, volumes in Oil futures have been rising, while silver's have been almost non-existent. I don't know what to make of that anomaly.

Usually when bubbles pop, the entire parabolic move is given back, although not necessarily all at once. If Oil positions continue to be cashed out, we could see Oil back at about $85. Which would, of course, be good for the economy.

The cure for high prices continues to be . . . high prices.

P.S. Due to the necessity of earning a living, Weekly Indicators will go up tomorrow. There will also be a double-special weekend diversion!