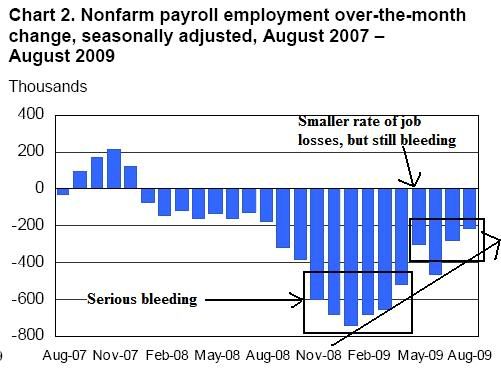

Although many forecasters now expect growth to improve, they also expect the unemployment rate to rise to near 10 percent at the end of this year or the beginning of 2010. Actual numbers are trending in that direction. The unemployment rate climbed to 9.7 percent in August, even though nonfarm payroll jobs had the smallest decline so far this year.

I too anticipate that the unemployment rate will continue to creep up for a little while longer. We will continue to hear about this as a concern in news reports in coming months. Yet, we know that the unemployment rate is a lagging indicator. We will see the unemployment rate come down only well after the economy begins to recover.

Unemployment is a lagging indicator? Who knew!

Seriousl, let's place the employment picture in a very necessary context. At the beginning of this year we were printing job losses in the 600,000/month range. An economy as large as the US and one that experienced that amount of pain is not going to turn around it's employment picture overnight. Consider the following chart of job losses from the latest employment report:

For four months we experienced job losses over 600,000. That means the following 9-12 months are pretty much dead issues from a growth perspective. To expect otherwise -- that is, to expect unemployment to drop or hold steady -- is just plain stupid. What that means is we need to put policies in place that deal humanely with an increasing unemployment picture.

A key element of the improving outlook is the better news from the housing market. Housing sales and starts have generally shown improvement over the past six months, and even house prices appear to have bottomed out this summer.

See this post from yesterday.

The outlook for consumer spending is a mixed bag. The good news is that while the "cash for clunkers" effect on auto sales appeared to be significant, measures of consumer spending that exclude automobiles and gasoline have stabilized and the prospects have improved somewhat. Nonetheless, there are reasons to remain cautious in one's outlook: employment remains weak and housing values, while showing some signs of life, remain well below their pre-crisis levels. On the other hand, increases in equity values have helped restore some strength to household balance sheets.

This remains the big issue for the outlook. As Invictus has written, there are strong reasons to be incredibly concerned about the prospect for consumer spending. However, I am more optimistic about the outlook. Only time will tell who is right.