As consumers max out their credit lines and banks clamp down on lending, many older and middle-class Americans are resorting to pricey, often-risky alternatives to stay afloat. Some are depleting their retirement accounts, tapping 401(k)s for both loans and hardship withdrawals. Some new fast-cash options allow homeowners to squeeze equity from their houses -- without the burden of monthly payments. One new product offers a one-time payment. In exchange, the company shares in as much as 50% of any future gain or loss in the property's value, typically collecting proceeds when the house is sold.

Americans are resorting to these more extreme measures due to the combination of dwindling jobs, falling home prices, shaky credit markets and a sharp run-up in food and energy prices. Consumer confidence hit a 28-year low in May, according to the latest Reuters/University of Michigan survey of consumer sentiment. Consumer spending and income inched up 0.2% in April from March, but after adjusting for inflation were flat, government data show.

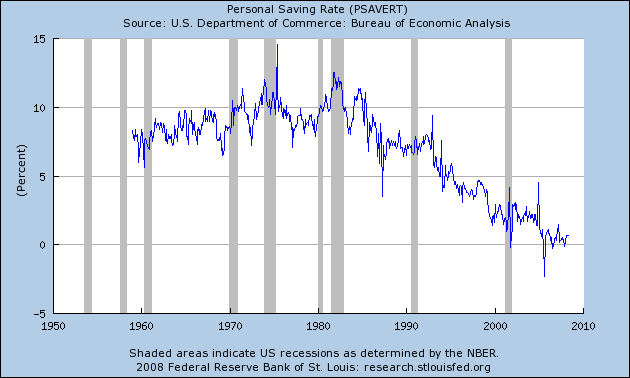

Let's back-up in time a bit. Here is a chart of the personal savings rate from the St. Louis Federal Reserve:

The official savings rate is essentially income less all possible expenses. The logic is people spend and then save. Notice that at the beginning of this expansion, people were already spending practically everything they made. That situation has only become worse.

At the same time, real median household income has dropped:

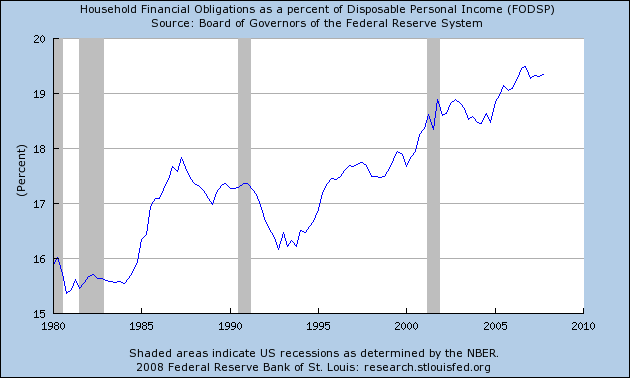

Over the course of this expansion consumers have been stretching their finances in a big way, thereby increasing the household financial obligations ratio.

Put those three conditions together and you already get a consumer that is strapped for cash.

Now we learn that consumers are stretching their already meager savings to maintain their already overstretched lifestyles. Simply put, that is not a good development at all.