Crude oil traded near $108 a barrel in New York after rising to a record yesterday as investors bought futures because the returns have outpaced those of financial markets.

Oil in New York surged 80 percent over the past year as the S&P 500 and Dow averages dropped. China, the second-biggest oil- consuming country, increased crude-oil imports by 18 percent last month and halted overseas shipments to meet rising demand.

``Momentum coupled with sufficient fundamental underpinnings, such as the Chinese oil-import data for February, keeps propelling us,'' said John Kilduff, senior vice president of energy at MF Global Ltd. in New York. ``The grab for hard assets is on due to the lack of confidence in the rest of the markets at the moment.''

The Big Picture made a very astute observation::

The Fed has complicated the current situation: In both September and January, the FOMC aggressively cut rates, in both instances, much more than expected. A measured response from the Fed would have been appropriate; however, their panicky monetary policy will ultimately backfire. This was a credit problem - not an interest rate problem.

The bigger issue is the Fed signaled to speculators in the commodities and currency markets that the they were throwning in the towel on inflation, and were prepared to print money until we run out of ink. Its no coincidence that Commodities then exploded upwards - the biggest monthly moves since the 1970's - along with the dollar tanking, and gold rallying 40% since August 2007.

Let's take a look at the charts:

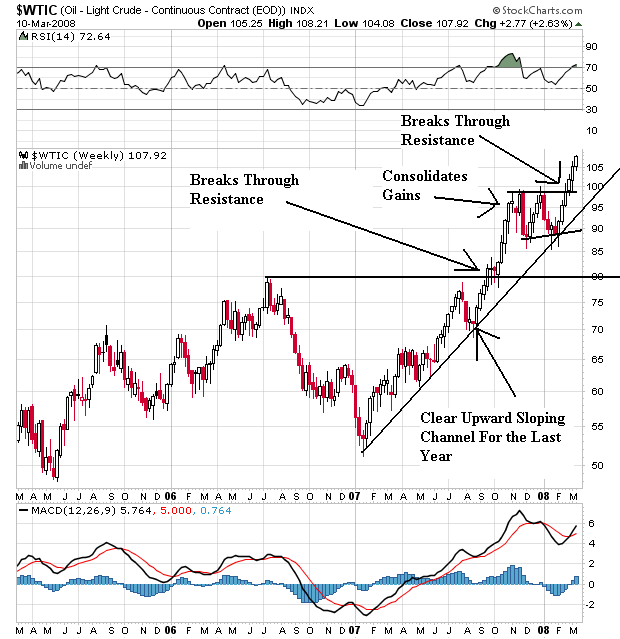

Note the following:

-- The market has been rallying for the better part of a year.

-- In September 2007 the market broke through upside resistance established in July 2006.

-- At the end of last year and beginning of this year prices consolidated gains above previous highs.

-- Prices broke through resistance again within the last month

This is a very bullish chart.

The real question will be what happens when the market corrects. If it corrects above the upper boundary of the late 2006 - early 2007 consolidation range, then expect further moves higher.

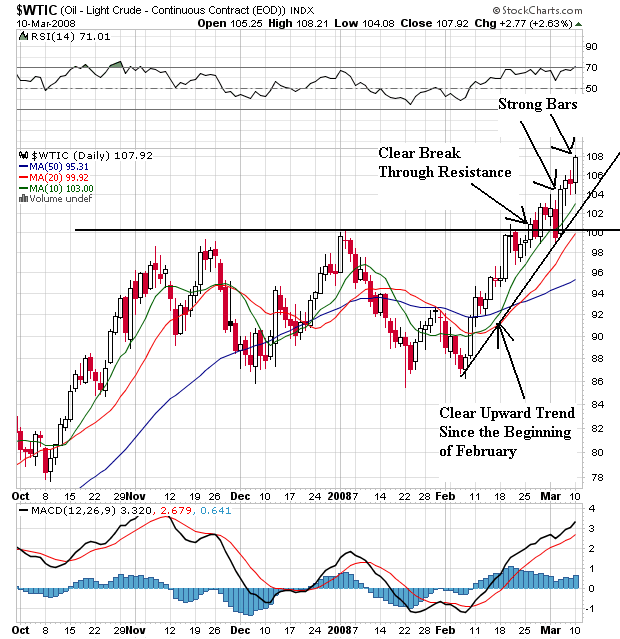

On the daily chart, notice the following

-- We get a good picture of prices moving through upside resistance.

-- The market has been in an upward sloping trend line since the beginning of November

-- Prices are above the SMAs

-- The shorter SMAs are above the longer SMAs

-- All the SMAs are moving higher.

This is also a very bullish chart.