Attention turns Wednesday to the tech sector, as Apple reported a 58% fiscal first-quarter profit rise, but it steered the market to expect it will earn 94 cents a share in this quarter, well below analyst estimates of $1.09.

"The company is low-balling the Street on the March quarter, but this is not a good environment to lowball the market," said Romeo Dator, who manages U.S. Global Investors All-American Equity Fund. Apple shares dropped nearly 10% in Frankfurt trade.

I usually don't write on a specific company, especially in tech, but this is important. Consider the above story in conjunction with these breadth charts:

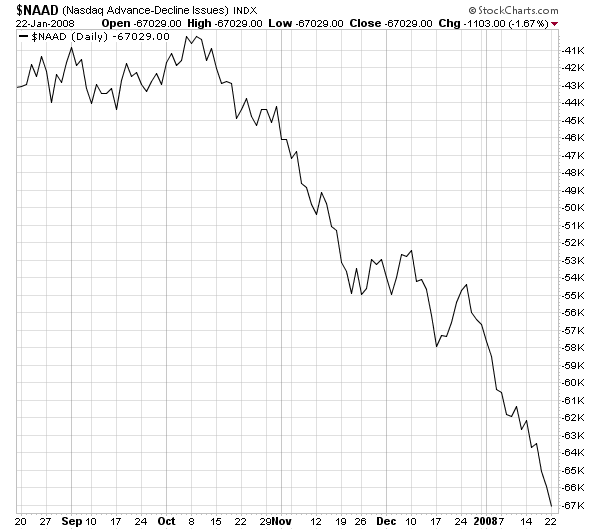

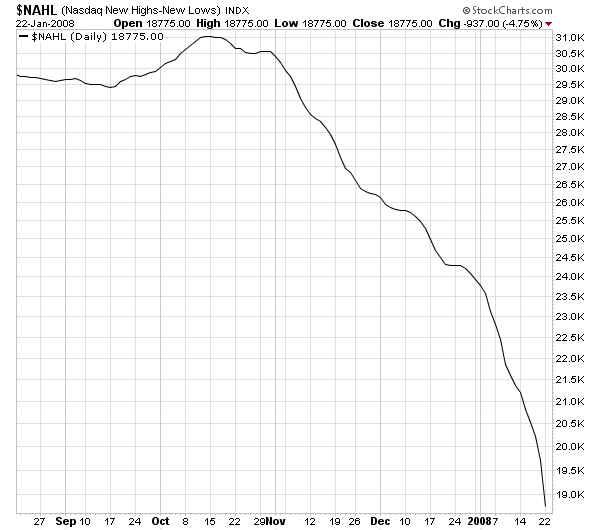

NASDAQ's advance/decline line and new highs new lows line has been decreasing since October. This is a prime reason why I have not bought into the "tech will save us" bandwagon. The bottom line is fewer and fewer issues are advancing and making new highs. As a result, fewer and fewer stocks are responsible for the market's gain.

Apple was one of those stocks responsible for the market increasing. But now it's being conservative with its earnings and it's dropping hard as a result. A final piece of the NASDAQ puzzle is starting to fall.