U.S. retailers may struggle to boost sales this month as consumers grappling with lower home values and higher food and energy costs shun full-priced goods.

Target Corp., the second-largest U.S. discount chain, said yesterday that it needs sales to ``meaningfully improve'' in December to achieve fourth-quarter profit growth. J.C. Penney Co., the third-biggest department-store chain, expects sales at stores open at least 12 months to fall for the five weeks through Jan. 5.

Retailers may cut prices further during what the National Retail Federation in Washington forecasts will be the slowest holiday shopping season in five years. Consumers contending with defaults on mortgages and higher costs for milk and gasoline may wait until closer to Christmas to spend, hoping for discounts of 50 percent or more on sweaters and electronics.

``I don't think there's going to be anything that's going to take the focus away from price,'' said Christian Andreach, who helps manage more than $15 billion at Manning & Napier Advisors Inc. in Fairport, New York. ``Everyone's pretty much aware of the negatives.''

As I've said many times, predicting the demise of the US consumer is a very difficult prediction. Americans love to shop and will do anything to keep shopping.

That being said, consider the following:

U.S. homeowners’ real estate equity dropped a record $128.5 billion, or 1.2%, in the third quarter to $10.6 trillion as home prices fell and mortgage debt rose. That’s the second quarterly decline after surging 38% from 2002 through the end of last year. In the second quarter of this year, homeowners’ equity dropped by $31.4 billion from the peak, $10.7 trillion, reached in the first quarter.

Fed President Yellen made the following observation in her latest speech related to equity withdrawals:

At the same time, the fall in house prices may constrain consumer spending by changing the value of mortgage equity; less equity, for example, reduces the quantity of funds available for credit-constrained consumers to borrow through home equity loans or to withdraw through refinancing.

In addition, gas prices are much higher this year than last year:

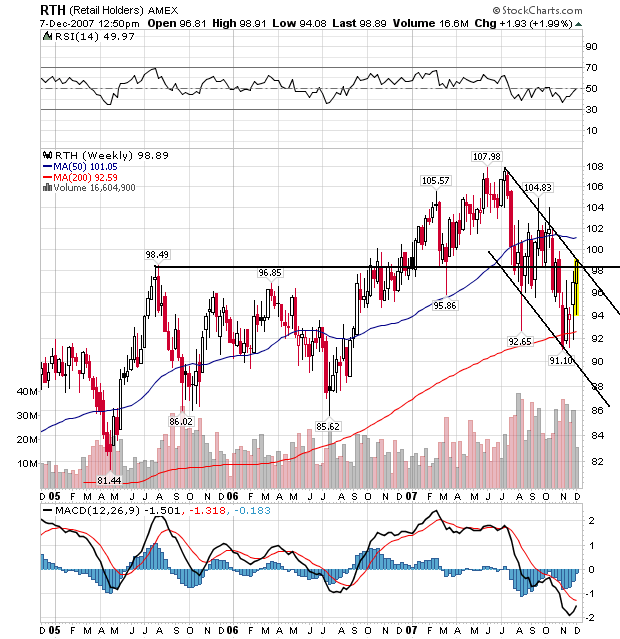

Traders have noticed all of this, as evidenced by the retail ETF:

The retail ETF has been heading lower in a downward sloping channel since the beginning of January. The EFT is close to an important technical barrier. If it continues to move higher it could signal an end to the downtrend. The oversold reading on the MACD would indicate that is possible right now, and the RSI is at 50 implying the index could go either way.

Retail is an incredibly difficult sector to read -- at least for me. There are a ton of conflicting signals right now along with the overall propensity of the US consumer to shop.