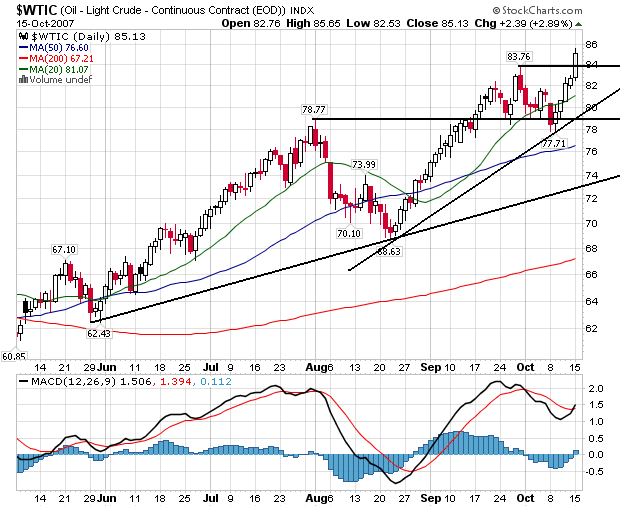

This chart is pretty straightforward. Oil started to rise in mid-August, and broke through resistance in mid-September. At this time, resistance turned into support. The market sold-off to near the 38.2% Fibonacci retracement level of $77.98, and then started rising again. Now oil is at an all time high.

Here are some of the reasons why:

A weakening U.S. dollar, low U.S. crude inventories and increased buying by investment funds also supported prices, counterbalancing expectations of higher inventories in the weekly U.S. supply report.

Iraq's Vice President Tareq al-Hashemi arrived in Ankara Tuesday in an apparent attempt to convince Turkey not to stage a cross-border offensive to fight separatist Kurdish rebels based in Iraq. Mr. Hashemi, a Sunni Arab, was scheduled to meet with Prime Minister Recep Tayyip Erdogan and other senior officials. The Turkish Parliament was expected to approve a motion Wednesday allowing the government to order a cross-border attack over the next year.

The Turkish government's decision Monday to ask Parliament for permission to pursue Kurdish rebels into Iraq stoked the worries about potential interruptions to oil supplies. "Whenever there is any escalation in political tensions in the Middle East, oil markets become concerned," said David Moore, a commodity strategist at the Commonwealth Bank of Australia in Sydney. "There is production and there are pipelines that people worry may be affected if there are any issues in Iraq."

There have been several skirmishes along the Turkey-Iraq border already. Although oil coming out of the region has been erratic, a total disruption would send prices higher, analysts said.

Regarding oil stocks, here is a chart of US oil inventory from last week's This Week in Petroleum:

While US inventories are high by historical standards, they have been dropping since mid-summer. Now oil stocks have to be replenished at higher prices -- not a good signs.

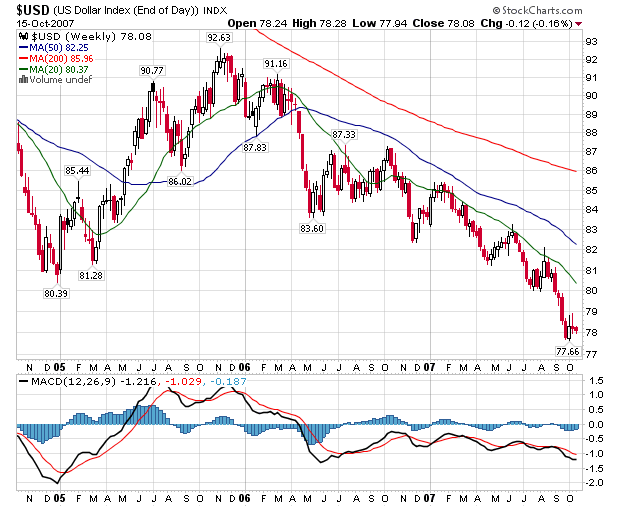

Then there is the weak dollar. Because oil is priced in dollars, a lower dollar means high oil prices. Here is the dollar's weekly chart.

Then we have the geo-political element of oil prices:

Nov. oil futures shot up $2.44 to $86.13 a barrel as Turkey appeared to move close to military action vs. Kurdish guerrillas in northern Iraq. That threatens the Kirkuk-Ceyhan pipeline, which supplies half-a-million barrels a day. Meanwhile, OPEC said noncartel output would be less than expected. That comes as rich-world inventories have declined in recent weeks.

Finally we have increased institutional buying as traders simply chase some profits.

In other words we have a lot really important fundamental reasons why oil is moving higher.