LONDON (Thomson Financial) - US crude oil stocks fell by a greater-than-expected 3.8 mln barrels in the week to Sept 14, while gasoline inventories rose by 400,000 barrels against expectations for a decline, the US Energy Information Administration said.

The report said, however, that at 318.8 mln barrels, US crude oil inventories remain at the upper end of the average range for this time of year.

The following charts are from This Week in Petroleum

Gas prices are supposed to drop in the fall as the summer driving season ends. However, with tight supplies the possibility of gas prices remaining at current levels or moving higher is increasing. The price trend for 2007 isn't along far enough to say prices will definitely be higher. But this week's move (or lack thereof) should put people on notice that this year might be different.

Gas stockpiles are way below normal, even though

oil stocks are at the upper end of their range.

Also note the demand has increased from last year.

This is a situation we'll have to keep an eye on. Remember from the price chart that US consumers had very high gas prices in the spring before the beginning of the summer driving season.

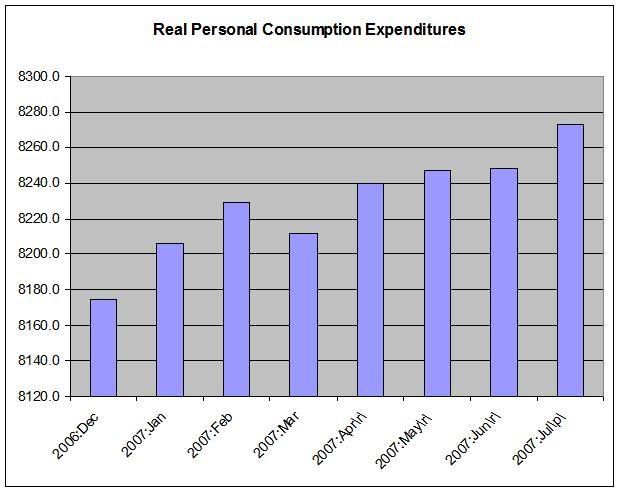

Above is a chart of inflation adjusted personal consumption expenditure, seasonally adjusted at an their respective annual rates. Notice this spring that the increase in these expenditures wasn't that impressive. I am guessing that gas prices had something to do with that. If we have a similar gas price problem going into the fall we could have some serious trouble.