First, here's what the FB said about the euro:

The British Pound and Euro represent suitable alternatives to the USD. Both are strong currencies backed by political and monetary stability, as well as strengthening economies and rising interest rates. Risk-averse investors can already earn comparable returns from the side of the Atlantic opposite the US. In addition, as European capital markets expand and develop, foreign investors are discovering new assets to scoop up. Private equity and other forms of alternative investing are booming in Britain and the EU, which means even investors in search of risk have options in Europe.

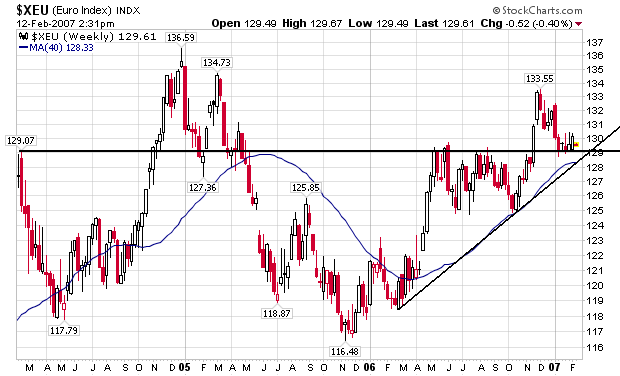

Here's a chart of the euro, courtesy of stockcharts:

Notice the euro has been in an uptrend for the last year. It is currently testing support at roughly 129. Looking at the chart, 129 looks like an important number for the euro. If it successfully tests this level another solid rally looks very possible.

Here's what the FB said about the dollar:

The USD has begun 2007 in neutral, idling against most of the world’s currencies, even gaining a few PIPS. However, this current period most likely represents a respite-rather than a reversal-from the USD’s long-term downward trend. The fundamentals behind the USD haven’t changed; if anything, they have worsened. Meanwhile, as the price of oil sinks back to sustainable levels and Central Banks move to diversify their reserves, governmental demand for USD-denominated assets may begin to stall.

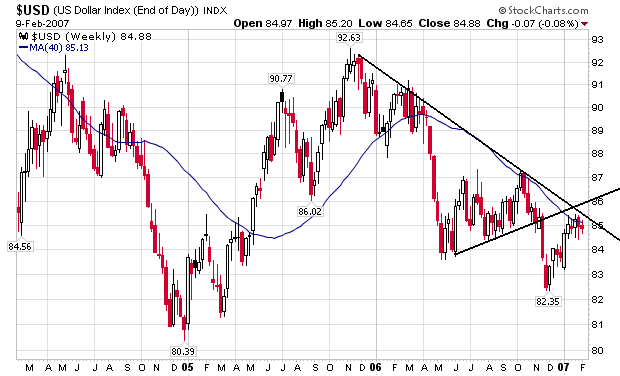

And here's a chart for the dollar that represents everything the FB said about the dollar.

Starting from the end of 2005, the dollar has been on a clear downward trajectory. Given the clusters of small candles at the top of the latest upward move, it's doubtful the dollar will be able to break the downward trend.