Tenth District manufacturing activity growth continued to edge down in December, while expectations for future factory activity rebounded strongly from the previous month. Most price indexes in the survey declined, with many indexes recording their lowest levels in over a year.

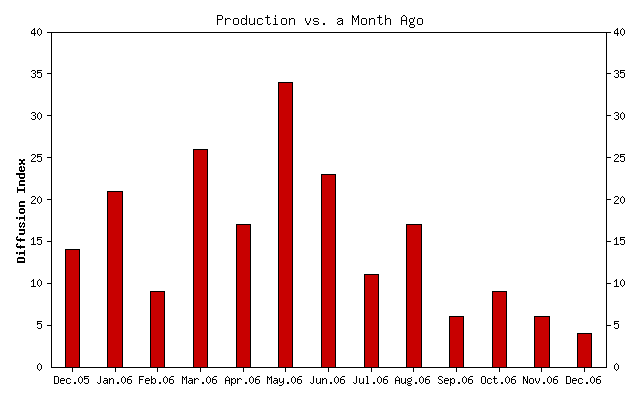

The net percentage of firms reporting month-over-month increases in production in December was 4, down from 6 in November and 9 in October (Tables 1 & 2, Chart). Production decelerated at both durable- and nondurable-goods-producing plants. The year-over-year production index also decreased from 35 to 25, a two-year low. On the other hand, the future production index rebounded from 15 to 27 after four straight months of decline. Although sample sizes make it difficult to draw firm conclusions about individual states, the data available suggest that production remained well above year-ago levels in all district states.

Here is a chart of the overall diffusion index:

This report is consistent with other Fed area manufacturing reports this month. The general consensus seems to be the current slowdown is temporary. Everyone is expecting orders to pick-up in six months. For example, 49% of respondents think production will increase in 6 months and 50% of respondents think shipments will increase in 6 months. On the inflation expectation front, only 29% of respondents think the prices they receive will increase in 6 months, although 44% think raw material's prices will increase in six months. This may partially explain why only 34% of respondents think they will have more employees in six months. Cutting back on hiring will allow manufacturers to maintain current margins.